Attending the أبوظبي للأنظمة ذاتية الحركة | Abu Dhabi Autonomous Summit 2025 offered me an impressive look at how the UAE — and Abu Dhabi in particular — are positioning themselves in the rapidly evolving global landscape of autonomous mobility across land, air, and sea.

What became clear throughout the summit is that the UAE is not trying to compete with the Europe🇪🇺, USA🇺🇸, or China🇨🇳 on their terms — it is carving out its own distinct niche defined by speed, clarity of vision, and strategic alignment between public and private sectors. A few examples:

🚀 A global benchmark-setter, not a follower

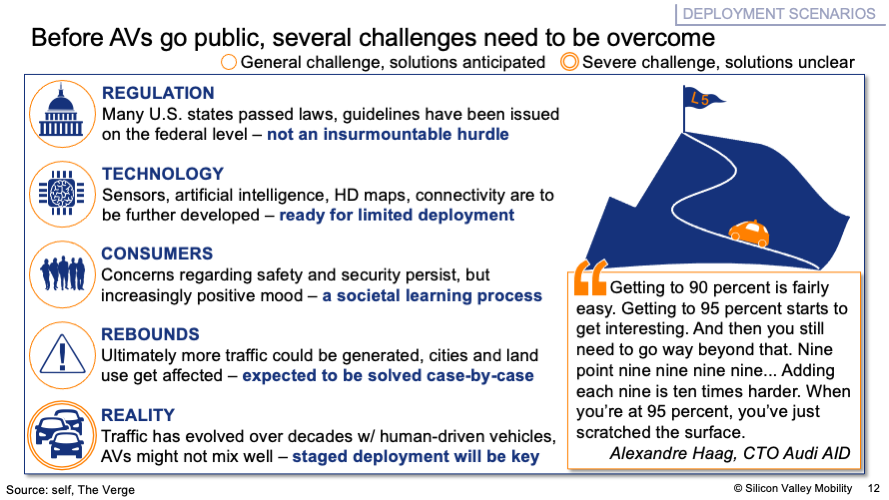

In their opening remarks, officials stated they are “not waiting for international standards — but setting benchmarks.” This positions the UAE as a place where global players can test, deploy, and refine technologies alongside evolving regulatory frameworks, rather than waiting for them to catch up.

⚙️ A deployment-focused alternative to the major innovation hubs

While the USA is strong in research, Europe in safety and industrial excellence, and China in scale, Abu Dhabi emphasizes deployment speed. Processes that take months elsewhere can be completed in weeks, creating a compelling environment for companies seeking real-world pilots, not just pilots on paper.

🛠️ From technology buyer to technology builder

Through strategic clusters like SAVI | Smart & Autonomous Vehicle Industry, Abu Dhabi is evolving into a creator of technology — a complementary pole to established innovation ecosystems in Silicon Valley, Shenzhen, and Europe’s automotive heartlands.

🤝 A governance model based on co-creation

The UAE highlights a regulatory philosophy built on collaboration, in which the private sector is the driver and the public sector the enabler, integrating agility with a strong emphasis on safety and public trust.

📊 Measured risk-taking as an economic asset

The UAE describes itself as a “sandbox of the world” — not because risk is ignored, but because risks are identified, mitigated, and managed. This enables innovation to keep pace with forward-looking regulation, a balance that is increasingly essential for global competitiveness.

🚁 A multi-modal vision of autonomy

From autonomous vehicles to maritime systems to more than 10 planned or operational vertiports, the UAE’s goal of 25% autonomous mobility by 2040 reflects a holistic and integrated mobility strategy.

🇦🇪 A diversified, talent-driven economy

Reducing petroleum dependency from 80% to 43% is not just an economic statistic — it signals a shift toward future industries supported by on-site talent, venture investment, and strong leadership.